The 2021 edtech avalanche has just begun

Last week was a good one for edtech in Europe.

GoStudent became Europe’s first edtech unicorn (IPO’d companies aside), raising its third round in 12 months and the biggest ever in the sector in Europe. Brighteye Ventures’ analysis showed that VC investments in European edtech had breached $1 billion in a calendar year for the first time, even without GoStudent’s mega-round, with six months left to go.

Edtech deal flow in 2021 looks set to match or even outpace 2020 levels, per the report: At $9.4 million, average deal size is triple 2020 levels; seven companies have raised $50 million in five different markets; and the U.K. has more than three times as many deals as the next individual market.

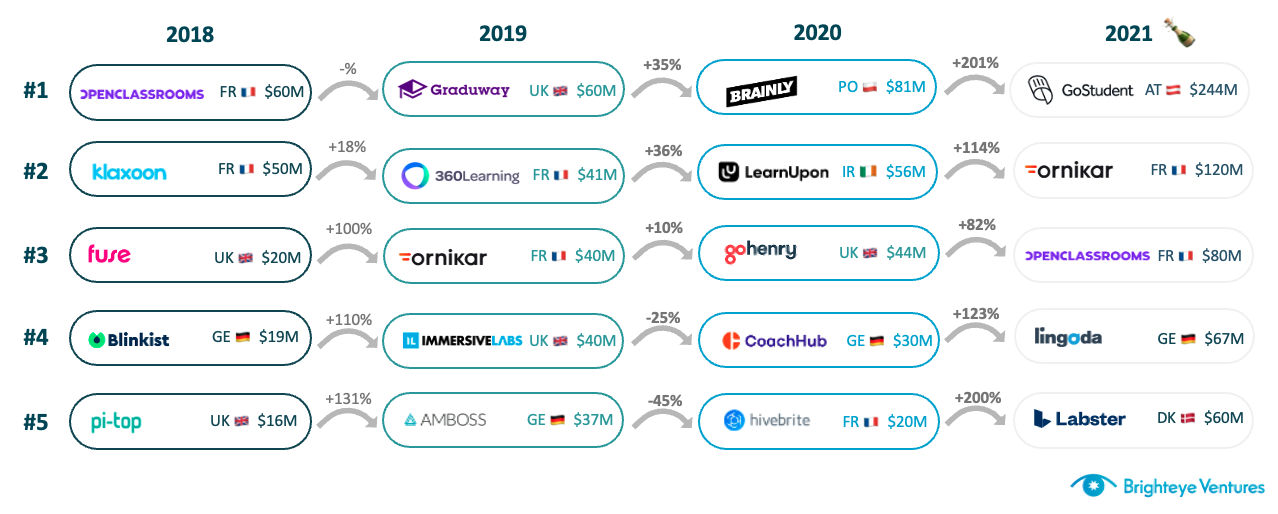

Deal-size progression in edtech over the years. Image Credits: Brighteye Ventures

It’s interesting that we are not seeing enormous increases in deal count. The $1.05-billion mark in the report is spread across 111 transactions — there were 237 in 2020, so we could expect a similar total this year. More funding and stable deal count of course means that we are seeing significant increases in deal size.

It seems generalist investors are recognizing that edtech investments can reap outsized returns, similar to sectors like deep tech, health tech and fintech.

We can draw a few conclusions from this. We can construe that companies created last year and in previous years matured significantly during the pandemic due to increased demand. Moreover, this rapid natural selection process provided insights on verticals and possible winners.

Lastly, it seems generalist investors are recognizing that edtech investments can reap outsized returns, similar to sectors like deep tech, health tech and fintech.

This is contributing to larger early rounds than we have seen in previous years — investors can’t pick the winner, but they can slant the playing field instead. We therefore expect to see a surge in the number of pre-seed, seed and Series A rounds in the second half of 2021, as companies founded during the pandemic begin to raise meaningful funding.

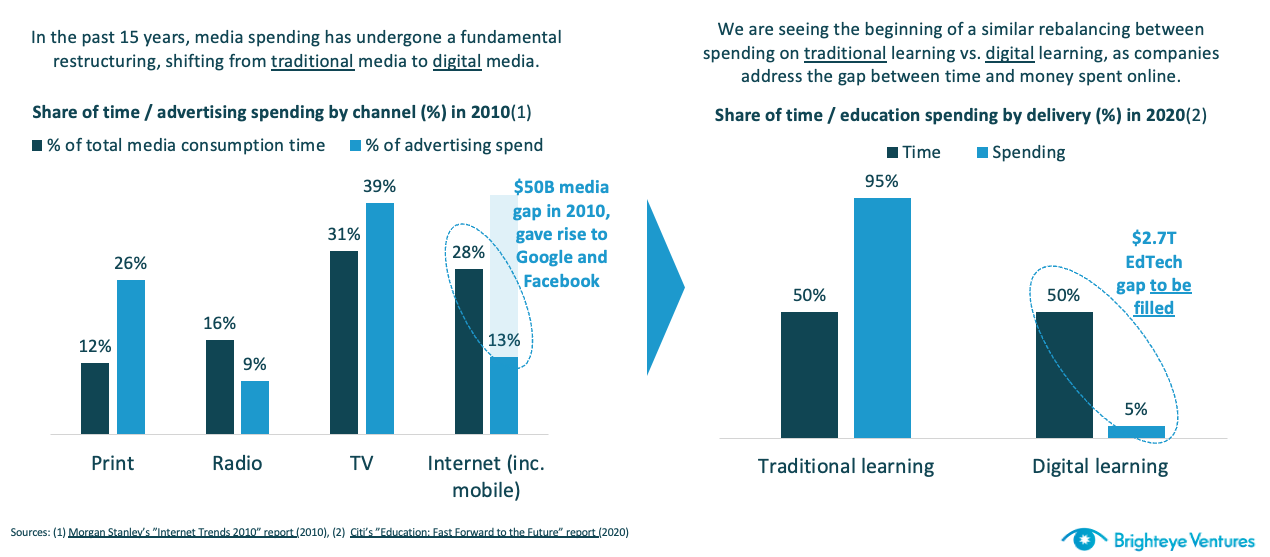

Another reason that edtech is being taken seriously by generalist investors is that the true size of the market (and the extent of digitization to come) is becoming more conceivable.

Edtech spending is growing like media spending did in the 2010s. Image Credits: Brighteye Ventures

from TechCrunch https://ift.tt/3qHD6PL

No comments